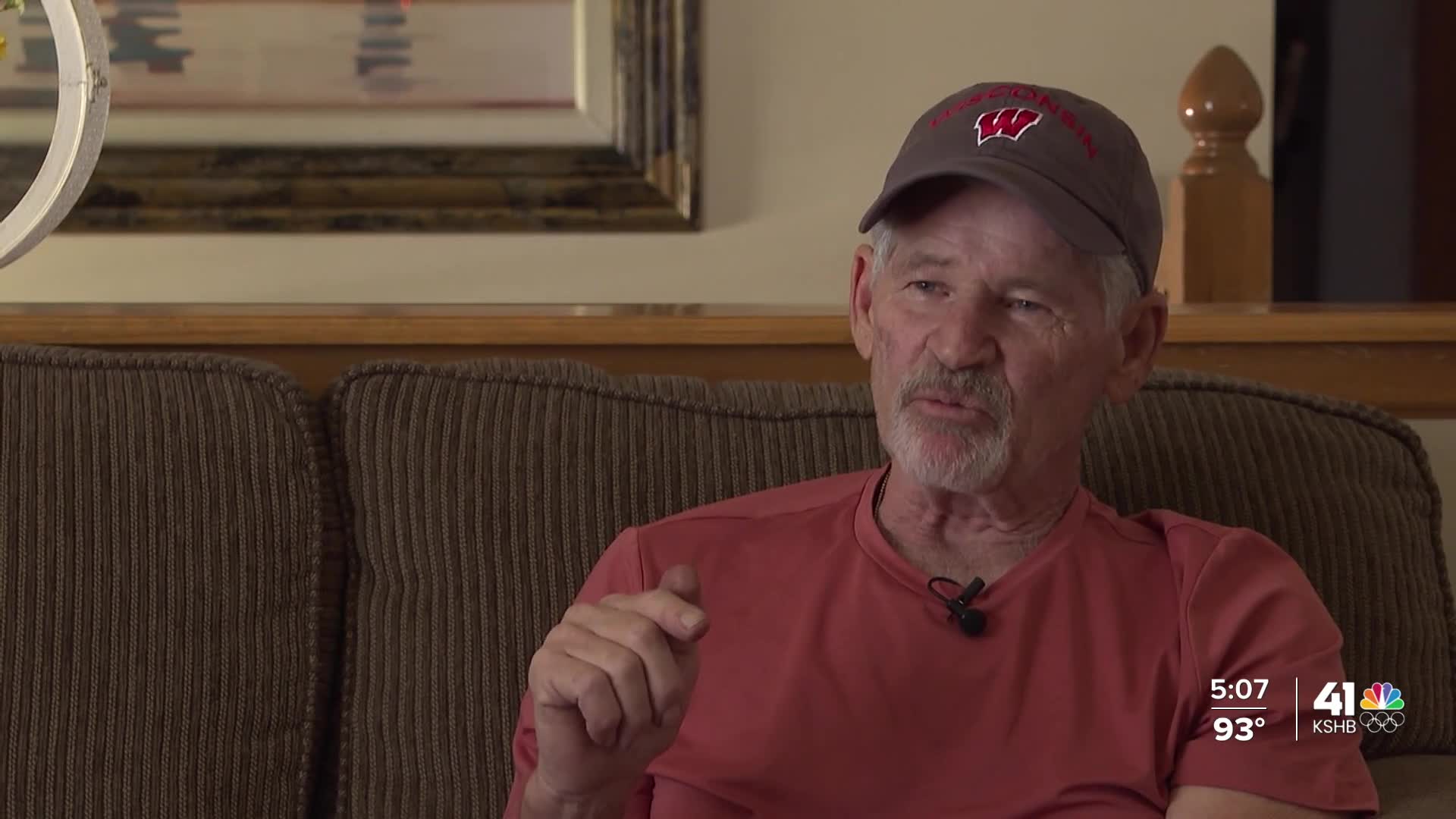

KANSAS CITY, Mo. — Pat Simon spends a lot of time sitting at the computer inside his Independence, Missouri, home.

Simon is reviewing emails from Jackson County’s Board of Equalization while waiting for an appointment to review his home’s property assessment.

VOICE FOR EVERYONE | Share your voice with KSHB 41’s Charlie Keegan

Last year, the county’s assessment department set Simon’s property value at $249,300, up from $151,000 in 2021. Simon appealed the assessment in June 2023, hoping the county would decrease the home’s value and save him money in property taxes.

Simon declined an offer to set the split-level home’s value at $200,000 during an informal hearing.

Simon’s next step is to meet with the county’s Board of Equalization to review the appeal.

Simon said the board canceled several meetings and claimed Simon missed a meeting .

He denies missing a meeting.

“I don’t even know where to go and I don’t know how many other taxpayers feel the same way,” Simon said.

Simon spoke with a supervisor Tuesday at the Board of Equalization. He said the supervisor told him the board will schedule a hearing for Simon after a new member joins the board this week.

County Legislator Manny Abarca said turnover within the board has partly contributed to long waits for people who filed appeals.

“The turnover of the chair, the turnover of the attorney. They were non-functional as well,” Abarca said.

There also was a record high number of appeals in 2023, with more than 50,000 property owners challenging the county’s valuation.

While waiting for a resolution, Simon had to pay his property taxes based on the $249,300 assessment. He hopes he can receive a reimbursement if the Board of Equalization reduces his home’s value during a hearing.

“I’m just a regular Joe. I don’t have a lot of money. I’m 70-years-old and still work every day,” Simon said. “I’m not sitting here fat and happy with extra money to give to the state.”

The Missouri Attorney General sued Jackson County leaders. The suit accuses them of violating state laws during the 2023 assessment process.

The trial began June 27, but is on break until July 8.

Abarca introduced a proposal Monday to let voters elect the county’s assessor instead of having the county executive appoint the assessor. The legislature assigned the proposal to a committee for review at a later date.

In April, Assessor Gail McCann Beatty told Abarca there are pros and cons to having an elected assessor. She pointed out she has more than 30 years of experience in the field while an elected candidate may not have those qualifications.

“I don’t have an opinion one way or the other. If the legislature and the state decides that’s what they want to do, that’s what happens,” McCann Beatty concluded at the time.

—