KSHB 41 reporter Abby Dodge covers consumer issues about personal budgeting and everyday spending. Send her a story idea.

—

Jackson County leaders stood united at a press conference Monday, pushing back against the Missouri State Tax Commission’s rollback of 2023 property assessments.

Thursday, a Jackson County judge accepted a request by the Missouri Attorney General’s Office to dismiss its lawsuit against the county over its 2023 assessment process.

County Executive Frank White Jr. said Attorney General Andrew Bailey’s lawsuit was “nothing more than a political ploy from the very beginning.”

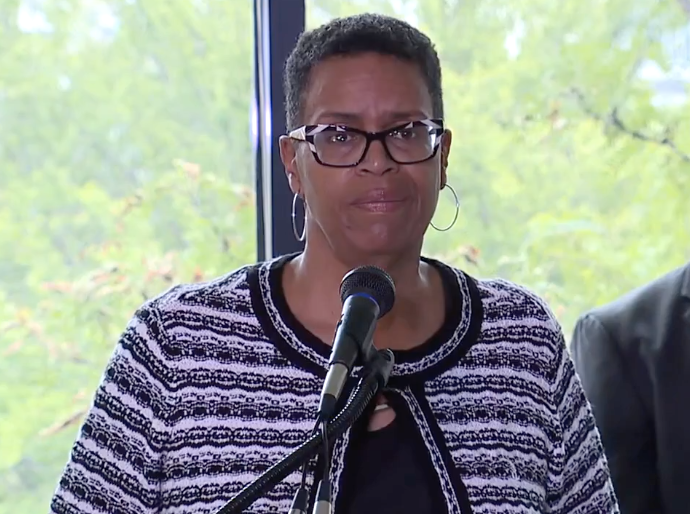

White was joined by leaders such as County Administrator Troy Schulte, County Counselor Bryan Covinsky and Assessor Gail McCann Beatty.

McCann Beatty acknowledged the process has not been easy, but she said it "must be done."

She also explained property valuations have not kept up in recent decades, often favoring "those with influence and wealth" over the working class.

But for any residents who are hopeful quick relief is forthcoming, Schulte dispelled that belief.

“I wanted to quickly disabuse everybody that there was going to be some tax relief coming. It’s not coming,” Schulte said.

Legislators explained last week that property tax money has already been passed on to cities and schools.

"Immediate refunds are just not a realistic possibility," Legislator Sean Smith said Thursday.

Anyone who feels they were overcharged is still encouraged to file an appeal.

RELATED | After rollback of 2023 Jackson County assessments, refunds not coming for property owners

The county could potentially challenge the STC order, which County Counselor Bryan Covinsky does not believe is enforceable.

Further, he explained the county does not plan to follow the order at this time.

“We are moving forward with the process as we have any appeal process,” Covinsky said.

Of the reasons for the rollback, the tax commission stated the county violated state statutes during the 2023 assessment process.

FULL COVERAGE | Property value assessments

At the Jackson County Legislature's weekly meeting, legislators planned to introduce a resolution in response to the commission’s ruling.

The resolution would let the legislature have the final say in approving legal action over $5,000.

After legislators talked in circles for more than half an hour, the resolution didn’t pass. It wasn’t even read into the record.

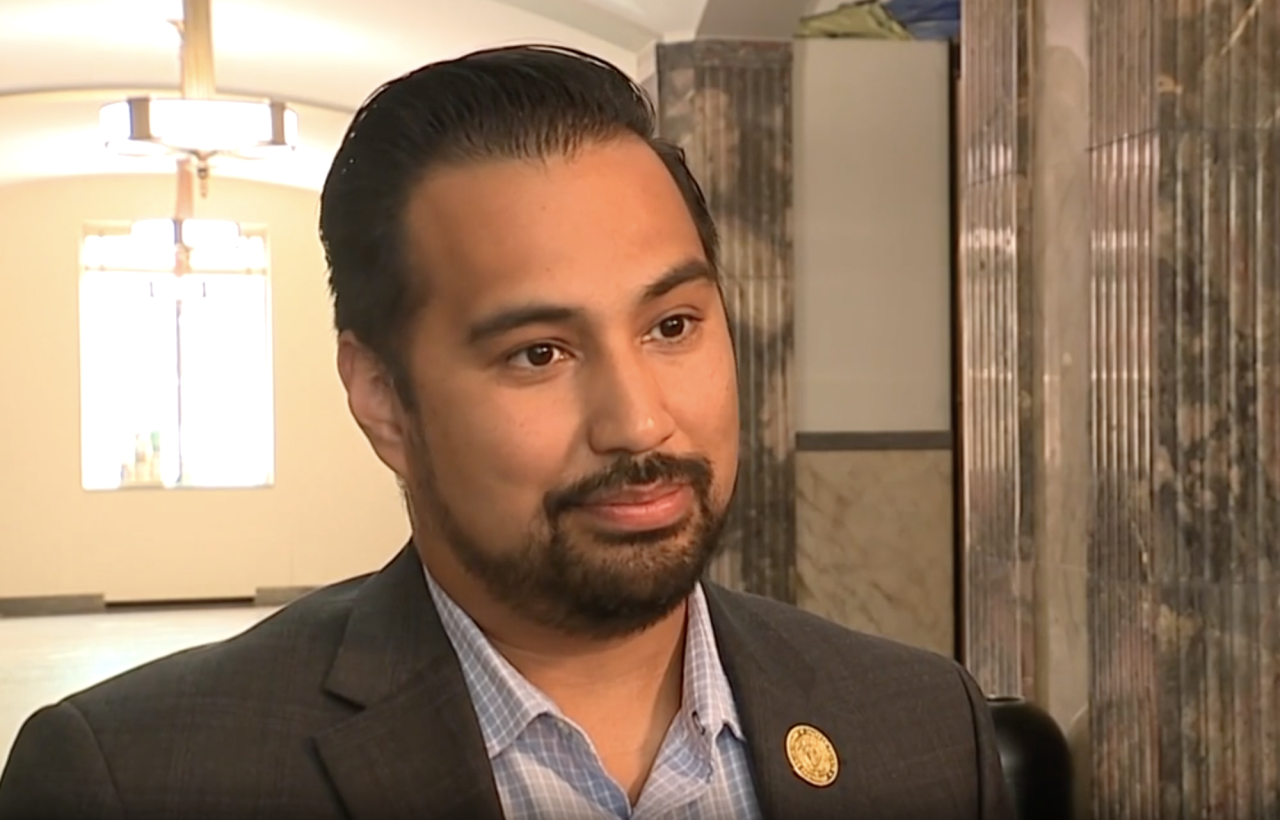

KSHB 41 reporter Abby Dodge asked Legislator Manny Abarca after the meeting what service circular conversations do for taxpayers.

“Zero service. Zero service at all," Abarca said. "The reality is that I have more opportunity if I talk to multiple superintendents and find common ground solutions than sitting in there trying to pedal around legislative action.”

Legislator Sean Smith questioned County Administrator Troy Schulte at the meeting on the fallout from the tax commission's ruling.

Smith said the county's actions during the assessment process were "unprecedented," pointing out the massive number of tax bill appeals from property owners.

One woman, according to Legislator DaRon McGee, had the property assessment on her house jump from $410,000 to $970,000.

She appealed the new valuation and got her property assessment reduced to $440,000.

Smith told Schulte he was worried the county over-collected $119 million, and if that money is not returned, it could balloon to a $250 million shortfall.

He also said while the county can't cover the entire $119 million, it does have some money to help cities and school districts.

When Dodge spoke with school districts last week, they said a swift decision might not be the best decision with the future of education and safety on the chopping block.

“At this point, all we can do is work together to make sure everybody understands that a quick decision can’t happen because it’s going to greatly impact hundreds of thousands of students across Jackson County,” said Oak Grove Schools Superintendent Mindy Hampton.

County legislators plan to introduce the resolution again next week.

—