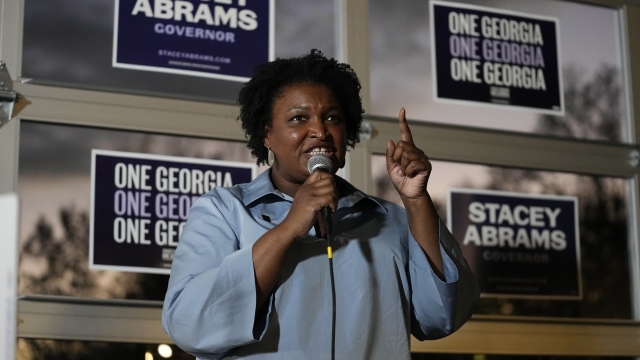

According to Pew Research, Black-owned businesses in the U.S. accounted for an estimated $141 billion in gross revenue in 2020. That's an 11% increase over 2017. But despite this growth, Black entrepreneurs run only 3% of U.S. companies. Former Georgia House Representative Stacey Abrams is working to change those statistics.

She's carving a path to success for Black women.

Patricia Wilson had always dreamed of owning her own business. She worked in the tech industry for years, but the thought of being her own boss stayed in the back of her mind.

"I did the nine-to-five and I just never felt in control of my destiny, and with my company, I'm in control of my destiny," said Wilson.

In 2012, she finally took the leap and started her own technology consulting firm, Online Media Interactive, putting over $5,000 of her own money into the business.

But her first year of operations yielded only an $800 return.

It wasn't until the pandemic hit that Wilson's business would earn its first million in revenue, as companies scrambled to figure out how to host virtual events. Her company was in high demand. Her client list grew rapidly, and with it came some new challenges, such as cash flow.

SEE MORE: Black-owned businesses saw post-pandemic boom, but challenges remain

"I remember those days very, very clearly, just wondering whether or not money was going to hit the account in time for me to even pay my mortgage, and to pay people," said Wilson.

Many of her technology solutions clients paid on a net 30, 60 or even 90-day basis, which made it difficult for her to complete services for her clients and scale her business.

And then she met someone who introduced her to NowAccount, a business-to-business company that helps small minority and veteran-owned businesses manage their payments, founded by voting rights activist, author and politician Stacey Abrams and her business partner, Laura Hodgson.

"So over the course of the 9 years that I've been working with them, I've done $3 million worth of business that they have helped me find so that I could get the business up front," said Wilson

When Wilson learned that NowAccount was founded by Stacey Abrams, she was amazed. The two women have a lot in common — both Black women, both Georgians and both entrepreneurs.

"She's a writer, I'm a writer. I think we both have gap teeth. I mean, we're just, I think we're very similar and you know, like I said, I followed her for years and I think she's brilliant and amazing and the fact that she built this company that's literally helped me build my company is, is just mind blowing," said Wilson.

"Now came out of a problem that Laura and I experienced at an acute level. We had an amazing opportunity; we had a great business opportunity but couldn't get the funding," said Abrams.

SEE MORE: The correlation between integration, successful Black-owned businesses

Black women are the fastest growing group of U.S. entrepreneurs with almost 2.7 million businesses. However, they still face significant barriers such as bias, discrimination and limited access to funding, with just 0.2% of venture capital going to Black female founders, according to Goldman Sachs. Now has received $225 million from Goldman Sachs to launch the One Million Black Women in Business Now credit facility with the goal of leveling the playing field for small businesses.

"What Now does so effectively is actually close the gap. Say you've got a customer, you've got an invoice, you're just waiting for your cash, the delay can collapse your business. And so, what we want to do and what Goldman is so intrigued by with our company is that we close that gap, we get that cash into your hands early so that you can actually increase your cash flow. You can take risks; you can do what other businesses take for granted and you can do it now," said Abrams.

"The most successful business stories are ones where risks are taken and where those risks are successful and what we want to do is give more small business owners, especially women owned businesses, women like Patricia, the freedom to risk," Abrams added.

Investing in Black women can have a huge economic impact. Closing the earning gap could create anywhere from 1.2 to 1.7 million U.S. jobs, and add up to $450 billion to the annual GDP.

Trending stories at Scrippsnews.com